With an IRS refund scam, criminals steal a taxpayer’s identity and use it to their benefit in various illegal ways. They succeed with this theft by committing some form of tax refund fraud.

A victim usually faces a long resolution process that includes extensive reporting to law enforcement and different government agencies and possibly the return of stolen funds to the Internal Revenue Service.

The victim might also have to choose a new tax preparer for the future, close their existing bank account, change all of their online passwords or deal with other forms of fraud related to their stolen identity for years.

Warning Signs of Tax Refund Fraud

If you’re worried that your tax refund could be at risk, you should be vigilant about protecting your personal identity both online and in the real world. And keep an eye out for these top 3 warning signs of IRS refund scams…

1. You’re Contacted About Your Refund

Someone claiming to be a tax preparer contacted you via direct mailer, phone, email or social media to tell you about how they can save you money this year and help you get a huge refund. And you supplied them with your personal identifying and financial data.

Scammers eventually use your private data to procure a loan, credit card, or gain some other financial benefit. They might file a fraudulent tax return in your name and trick the IRS into sending a refund to them or allow you to receive the money and then manipulate you into sending it to them.

2. You’re Contacted by a “Taxpayer Advocate”

Someone claiming to work for the Taxpayer Advocacy Panel (TAP) or Taxpayer Advocate Service (TAS) contacted you via phone, email or social media about your refund. They asked for your personal information to supposedly help them confirm that they’re speaking to the right taxpayer or pull up your account.

The IRS never contacts a taxpayer via any of the mentioned methods in an unsolicited fashion. The IRS primarily sends a letter via the United States Postal Service. TAP representatives don’t have any access to the personal or financial data of individual taxpayers. TAS representatives only contact a taxpayer by phone if the taxpayer contacts the IRS first.

3. You Unexpectedly Recieve Funds from the IRS

A large amount of money from the Internal Revenue Service suddenly appeared in your bank account or you received an unexpected large refund check. Perhaps you tried to file your tax return and the IRS rejected it since there’s already one on file. You might have also spoken with someone who contacted you about returning the refund and followed their instructions.

With this scheme, criminals gained access to your private data at some point. The methods used include:

- They tricked you into providing personal details via online or over the phone.

- They hacked a computer at your tax preparer’s office.

- They mined data from your personal or business computer or smartphone.

The scammers filed a tax return in your name that featured false information so that they or you would receive a large refund.

If they convinced the IRS to send you the money, they contacted you some time after the normal scheduled period for the IRS to issue the refund and claimed that they represented the IRS or a collection agency working for the IRS.

They then gave you instructions to return the money. They might have used intimidation tactics to get you to comply, such as telling you that the IRS or collection agency can have you arrested for fraud or freeze your bank and other financial accounts.

But the IRS never calls taxpayers about returning refunds or to make threats related to law enforcement actions.

How to Deal with an IRS Refund Scam

If you received an email about a refund from someone claiming to be with the IRS, you’re dealing with a phishing scam. Forward the entire email with all sender details and headers to the IRS at [email protected] without opening any attachments or clicking any links. Once you’ve forwarded the email, delete it.

If you received a telephone call or voicemail, use the same email address to report the call with “IRS Phone Scam” as the Subject line. Include the date and time of the call, the inbound phone number, if available, the name of the person who called you and a return callback telephone number, if applicable.

Additionally, you should provide your physical location and time zone at the time of the call. You can also report a phone-based scam by using the Treasury Inspector General for Tax Administration IRS Impersonation Scam Reporting form.

The IRS recommends that taxpayers dealing with refund scams file complaints with their State Attorney General, the Federal Communication Commission, and the Federal Trade Commission. Additional information about phishing scams can be found on the IRS Report Phishing and Online Scams page.

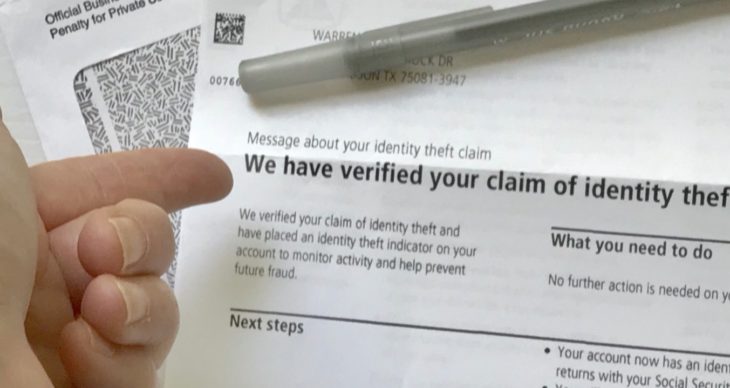

If you believe that it’s too late and a scammer has stolen your identity, then you need to contact the police, your financial institutions, the major credit bureaus, and the FTC. The IRS recommends that you also review the information and instructions outlined in its Taxpayer Guide to Identity Theft to help you navigate this specific type of event.

If you received an erroneous tax refund, you must return the money to the IRS within 21 days of receipt of it. To confirm the correct return method, non-business taxpayers should call 1-800-829-1040 and business owners should call 1-800-829-4933. You must also call the IRS for information about what to do if you no longer have the funds because you followed a scammer’s return instructions.

Stay Vigilant in the Future

Being the victim of an IRS refund scam is scary and frustrating. If you want to avoid having to deal with any type of identity theft, there are some quick and easy ways to monitor your credit and personal information.

One of the best ways you can avoid being the victim of identity theft is by taking a look at signing up for a reputable identity protection service. You’ll have ID theft experts monitoring your personal info 24/7 to make sure it stays safe and private.